MTN Mobile Money Uganda Celebrates Milestone with 2 Million MoKash Borrowers

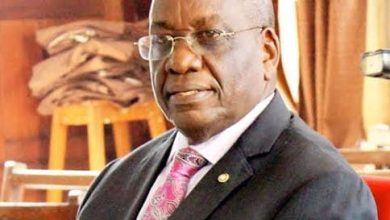

In a significant stride towards financial inclusion, MTN Mobile Money Uganda proudly announces that over two million customers are now eligible to borrow through its innovative MoKash platform. Richard Yego, Chief Executive Officer of MTN Mobile Money Uganda Ltd., highlighted this achievement, emphasizing the transformative journey from a basic send-and-receive platform to a multifaceted service provider.

MTN’s commitment to enhancing financial services is evident through strategic partnerships and diverse offerings. Yego mentioned the successful launch of MoMo Advance, an overdraft facility in collaboration with NCBA and MoSente, and the introduction of a term loan product in partnership with Jumo. These initiatives showcase MTN’s dedication to providing customers with a range of financial solutions.

The evolution of MTN Mobile Money goes beyond traditional transactions, with a keen focus on scaling cashless transactions to align with Uganda’s goal of becoming a cashless economy. The driving force behind this transformation is MoMo Pay, introduced in 2018. MoMo Pay allows users to utilize their phone’s funds for seamless payments, a feature that has rapidly gained traction. MTN processes over UGX 7 billion in transaction value daily through MoMo Pay, involving more than 280,000 active merchants across the country.

Uganda’s Fintech sector is experiencing a surge, with 29 licensed Fintechs operating under the National Payment Systems Act 2020. These innovative ventures are revolutionizing financial services, contributing to inclusive access to banking, payments, and lending. Digital technologies empower individuals and businesses, fostering financial inclusion and driving economic development.

In tandem with this financial revolution, Uganda’s e-commerce sector is booming, projected to reach a value of $2.5 billion by 2025. This growth not only unlocks new possibilities for entrepreneurs but also expands market reach, ultimately promoting economic growth.

MTN Mobile Money Uganda’s achievement of reaching two million borrowers on MoKash underscores its pivotal role in driving financial inclusion and shaping the landscape of digital financial services in the country. As the Fintech sector continues to expand, MTN remains at the forefront, facilitating a cashless future for Uganda.